Why Should you Opt for Money View Personal Loans in Gurgaon

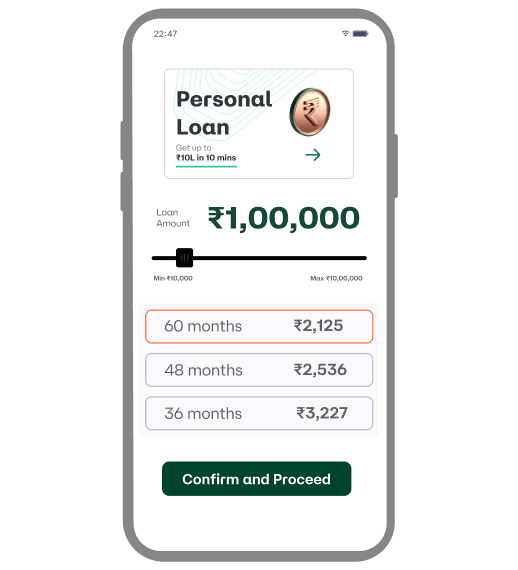

Flexible Loan Amount

You can avail personal loans of up to Rs. 5 lakhs

24 Hour Loan Disbursal

We understand the urgent need for finance which is why our loans are credited to your account within 24 hours of application approval.

No Collateral Required

You don’t have to arrange for any guarantor or pledge any asset while applying for personal loans from Money View

Affordable Interest Rates

We understand how important interest rates are as they determine the EMI amount to be paid. At Money View, the interest rate starts at just 1.33% per month